Raising funds is crucial for taking an idea from concept to reality. However, getting investors’ attention is becoming increasingly challenging in today’s oversaturated marketplace.

This is where strategic LinkedIn outreach comes into play.

A targeted Investor Pitch sequence has the power to effectively communicate your value and vision to venture capitalists who control the resources you need to launch or scale your startup.

In this post, we dive deeper into best practices for developing compelling Investor Pitch sequences that capture investors’ interest.

What is an Investor Pitch LinkedIn Sequence?

An Investor Pitch LinkedIn Sequence is a series of customized messages sent via LinkedIn to potential investors in order to secure fundraising for a business or project.

Here are some of its key characteristics:

- Targets venture capitalists, angel investors, high net-worth individuals, and other funding sources.

- Focused specifically on pitching the value proposition of your business or idea.

- Emphasizes metrics like traction, projections, ROI potential, and addressable market size.

- Highly personalized to speak to each investor’s specific interests and background.

- Follows a consistent sequence over multiple touches to build interest and trust.

The Investor Pitch Sequence stands apart from other marketing techniques because it is laser-focused on obtaining financing, rather than broader customer acquisition or sales.

The messaging aligns closely with what an investor presentation deck would include.

However, it allows you to reach more potential funders through leveraging your LinkedIn network and enables an ongoing, two-way conversation to address concerns and questions before asking for a formal meeting.

Why is the Investor Pitch LinkedIn Sequence Useful?

The Investor Pitch LinkedIn Sequence is an invaluable tool in the arsenal of digital marketing strategies, particularly for those seeking investment.

Its benefits and effectiveness are grounded in its ability to achieve specific marketing and fundraising goals.

Here’s why it is so useful:

- Direct Access to Investors: LinkedIn provides a platform to directly reach potential investors. This sequence bypasses traditional gatekeepers, allowing you to engage with venture capitalists, angel investors, and decision-makers in the investment world.

- Personalized Engagement: By tailoring messages to the interests and backgrounds of each investor, the sequence fosters a more personal connection, increasing the likelihood of a positive response.

- Credibility and Professionalism: LinkedIn is known for its professional networking environment. Using this platform for your pitch showcases your professionalism and lends credibility to your business proposal.

- Efficient Lead Generation: The sequence helps in identifying and engaging with the right investors efficiently, saving time and resources that might be spent on less targeted outreach methods.

- Building a Network: Even if an investor isn’t ready to commit, the sequence helps in building a long-term network of potential investors and industry contacts, which can be beneficial for future fundraising efforts.

- Cost-Effective Strategy: Compared to traditional marketing and advertising strategies, an Investor Pitch LinkedIn Sequence is relatively low-cost but can yield high returns in terms of investor interest and engagement.

In summary, the Investor Pitch LinkedIn Sequence aligns perfectly with the specific goals of raising capital and building investor relations.

It’s a strategic, targeted, and cost-effective approach that leverages the power of professional networking to directly connect with potential investors.

What Businesses Should Use Investor Pitch LinkedIn Sequence?

The Investor Pitch LinkedIn Sequence is particularly beneficial for certain types of businesses and industries where direct engagement with potential investors is crucial.

This strategy is most effective for:

- Startups and Entrepreneurs: New companies seeking funding to kickstart or scale their operations can greatly benefit from this sequence. It provides them direct access to angel investors and venture capitalists who are interested in emerging and innovative business ideas.

- Tech and Innovation-Driven Companies: Businesses in technology, biotech, AI, and other innovation-driven sectors often require substantial capital for research and development. These industries can use the sequence to attract investors who are specifically interested in cutting-edge technologies and groundbreaking projects.

- Small and Medium Enterprises (SMEs) Seeking Expansion: SMEs looking to expand their operations or enter new markets can leverage this sequence to connect with investors who can provide the necessary capital and strategic guidance.

- Companies Undergoing a Pivot: Businesses that are pivoting to a new model or product line may need fresh funding. The Investor Pitch LinkedIn Sequence allows them to present their new vision and business plan to potential investors.

- Green and Sustainable Businesses: With the growing emphasis on sustainability, companies in green technology, renewable energy, and sustainable practices can use this sequence to reach investors who are interested in environmentally friendly and socially responsible ventures.

- Real Estate and Large-Scale Development Projects: These sectors often require substantial investment. Utilizing LinkedIn to pitch to real estate investors and development funds can be an effective strategy.

- Creative and Cultural Industries: While not traditionally associated with LinkedIn, creative industries like film production, gaming, and arts can also benefit by reaching out to investors interested in supporting cultural projects.

The effectiveness of the Investor Pitch LinkedIn Sequence for these businesses lies in its ability to target specific types of investors who are not only capable of providing financial support but are also likely to be genuinely interested in the business’s specific industry or niche.

This targeted approach increases the chances of successful fundraising and building meaningful investor relationships.

Best Practices for Investor Pitch LinkedIn Sequence

Creating and executing a successful Investor Pitch LinkedIn Sequence requires adherence to best practices while avoiding common pitfalls.

Here’s a guide to optimizing your strategy:

Best Practices:

- Research Your Audience: Understand the interests, investment history, and preferences of your potential investors. Tailor your message to resonate with their specific priorities and values.

- Craft Compelling Content: Your initial message should be concise, engaging, and clearly articulate your value proposition. Highlight what sets your business apart and why it’s a worthwhile investment.

- Personalization is Key: Customize each message to reflect the recipient’s background and interests. Generic pitches are less likely to capture attention.

- Maintain Professionalism: Ensure your LinkedIn profile and content reflect a professional image. This builds credibility and trust with potential investors.

- Follow a Structured Sequence: Start with an introduction, followed by a value proposition, and gradually move to more detailed information about your business and the investment opportunity.

- Timing and Frequency: Be mindful of the timing and frequency of your messages. Avoid overwhelming recipients with too much information or too many messages in a short period.

- Call to Action: Include a clear call to action in your messages, such as scheduling a call or meeting to discuss the opportunity in more detail.

- Follow-Up Strategically: Have a follow-up plan but be respectful. Persistent follow-ups are good, but avoid being pushy or intrusive.

- Stay Updated and Relevant: Keep informed about current trends and news in your industry. This can help you make your pitch more relevant and timely.

Common Pitfalls to Avoid:

- Overgeneralization: Avoid sending the same generic message to all potential investors. Lack of personalization can lead to disengagement.

- Neglecting Profile Optimization: An incomplete or unprofessional LinkedIn profile can detract from your credibility.

- Ignoring LinkedIn Etiquette: Being too aggressive, using hard-sell tactics, or spamming can harm your reputation and alienate potential investors.

- Overlooking the Importance of Networking: Focusing solely on the pitch and neglecting to build genuine connections and networks on LinkedIn can limit your success.

- Inadequate Preparation: Approaching investors without a clear plan or understanding of your own business metrics and objectives can lead to ineffective pitches.

- Failing to Follow Up: Not following up or giving up too soon can result in missed opportunities. However, it’s crucial to balance persistence with respect for the investor’s time and interest.

By following these best practices and steering clear of common pitfalls, you can effectively utilize the Investor Pitch LinkedIn Sequence to connect with potential investors, present your business compellingly, and increase your chances of securing investment.

Examples of Investor Pitch LinkedIn Sequence

In this section, we explore three diverse examples of Investor Pitch LinkedIn Sequences, each tailored to distinct industries and funding stages.

These sequences demonstrate how to effectively engage potential investors through a series of strategic LinkedIn messages, showcasing their adaptation to various contexts with specific subject lines, content, and calls to action.

Sequence 1: Tech Startup Seeking Seed Funding

Objective: To secure seed funding for a tech startup specializing in AI-driven analytics.

Message 1: Introduction and Interest Spark

- Subject: Revolutionizing Analytics with AI

- Content: Brief introduction of your startup and its unique AI-driven solution in the analytics field.

- CTA: Express interest in discussing potential investment opportunities.

Learn how to create this LinkedIn message template:

Message 2: Value Proposition

- Subject: Transforming Data into Decisions

- Content: Highlight the unique value proposition of your AI solution and how it stands out in the market.

- CTA: Suggest a brief call to discuss the potential impact on the industry.

Learn how to create this LinkedIn message template:

Message 3: Demonstrating Traction

- Subject: Proven Impact and Growing Demand

- Content: Share success stories, customer testimonials, or significant milestones achieved by your startup.

- CTA: Invite for a more detailed discussion about your startup’s trajectory.

Message 4: Investment Details

- Subject: Join Our Journey: Investment Opportunity

- Content: Outline the investment opportunity, expected use of funds, and projected outcomes.

- CTA: Propose a meeting to discuss investment terms and potential partnerships.

Learn how to create this LinkedIn message template:

- Educational content LinkedIn message template

Message 5: Follow-Up and Engagement

- Subject: Exploring Synergies and Future Steps

- Content: Recap the previous discussions and emphasize the mutual benefits of a potential partnership.

- CTA: Request for a final meeting or decision regarding the investment opportunity.

Learn how to create this LinkedIn message template:

- Final follow-up LinkedIn message template

- Break-up LinkedIn message template

Sequence 2: Sustainable Energy Company Expansion

Objective: To attract investment for expanding operations in the sustainable energy sector.

Message 1: Initial Outreach

- Subject: Leading the Change in Sustainable Energy

- Content: Introduce your company and its role in the sustainable energy sector.

- CTA: Express interest in discussing investment for expansion.

Learn how to create this LinkedIn message template:

Message 2: Impact and Mission

- Subject: Powering a Greener Future Together

- Content: Describe your company’s impact on the environment and its mission towards sustainability.

- CTA: Suggest a call to discuss the vision and goals in more detail.

Message 3: Market Potential

- Subject: Capturing the Booming Green Energy Market

- Content: Share insights into market growth, potential, and how your company is positioned to capitalize on these trends.

- CTA: Invite to discuss how an investment could accelerate growth.

Message 4: Expansion Plan

- Subject: Expanding Our Reach in Renewable Energy

- Content: Detail the specific plans for expansion and how the investment will be utilized.

- CTA: Offer to share a detailed business plan and financial projections in a meeting.

Message 5: Closing the Deal

- Subject: A Sustainable Investment Opportunity Awaits

- Content: Summarize the key points discussed and the unique investment opportunity your company offers.

- CTA: Request for a decision-making meeting or further engagement steps.

Sequence 3: Biotech Firm Seeking Series A Funding

Objective: To obtain Series A funding for a biotech firm specializing in innovative medical therapies.

Message 1: Intriguing Introduction

- Subject: Pioneering Breakthroughs in Biotechnology

- Content: Introduce your biotech firm and its groundbreaking work in medical therapies.

- CTA: Propose an initial conversation to discuss potential collaboration.

Learn how to create this LinkedIn message template:

Message 2: Scientific Credibility

- Subject: Advancing Medical Science for Better Health

- Content: Highlight key scientific achievements, research credibility, and endorsements from the medical community.

- CTA: Suggest a meeting to delve into the scientific details and potential impact.

Learn how to create this LinkedIn message template:

- Educational content LinkedIn message template

Message 3: Business Model and Scalability

- Subject: Scalable Solutions in Biotech

- Content: Describe your business model, scalability potential, and how your innovations can be commercialized successfully.

- CTA: Invite to discuss the business aspect and market opportunities in detail.

Message 4: Investment and Growth

- Subject: A Strategic Investment in Health Innovation

- Content: Outline the specifics of the Series A funding, including the expected use of funds and growth projections.

- CTA: Propose a meeting to discuss investment terms and future growth plans.

Message 5: Final Pitch and Engagement

- Subject: Transforming Healthcare: Your Opportunity

- Content: Reiterate the unique opportunity to invest in a leading-edge biotech firm and the potential for significant returns.

- CTA: Ask for a final meeting to conclude discussions or to receive feedback on the investment proposal.

Learn how to create this LinkedIn message template:

- Final follow-up LinkedIn message template

These sequences illustrate how the Investor Pitch LinkedIn Sequence can be adapted to various industries and objectives, with each message building upon the previous one to effectively engage potential investors.

How to Create Your Own Investor Pitch LinkedIn Sequence

Discover the art of crafting an Investor Pitch LinkedIn Sequence in five simple yet powerful steps, designed to effectively connect with potential investors and amplify your fundraising efforts.

1. Define Your Investment Goals and Target Audience

Begin by clearly identifying your investment goals. Are you seeking seed funding to launch your startup, Series A funding for scaling, or capital for business expansion?

Clarity in your objectives is crucial. Next, conduct thorough research to identify your ideal investor. This involves understanding their investment patterns, industry preferences, and the scale of investments they usually make.

Look for investors whose interests align with your business sector and have a history of investing in similar stages as your company.

This targeted approach ensures that your pitch reaches the right audience, increasing the likelihood of finding a compatible investor for your unique business needs.

2. Develop a Compelling Value Proposition

The core of your pitch lies in a strong value proposition. It should crisply articulate what makes your business unique and attractive to investors.

Focus on what sets your product or service apart from the competition, be it through innovation, market potential, or your team’s expertise.

Your value proposition must resonate with your target investors’ interests, emphasizing how investing in your business can lead to significant benefits for them, such as high growth potential, entry into emerging markets, or alignment with their investment philosophy.

This step is about bridging the gap between your business’s strengths and the investor’s aspirations, creating a compelling reason for them to engage further.

3. Create a Structured Message Sequence

Designing a structured sequence of messages is key to keeping investors engaged. Start with a concise introduction that sparks interest.

This initial message should pique curiosity without overwhelming the recipient. Subsequent messages should gradually provide more depth, elaborating on your business model, market potential, and how you stand out in your industry.

Each message should logically build on the last, creating a cohesive narrative that leads the investor through your journey. Plan this flow carefully to maintain interest and engagement.

The final messages in the sequence should be more direct, culminating in a clear call for investment, inviting investors to be a part of your business story.

4. Personalize and Optimize Each Message

Personalization is crucial in making your messages resonate with potential investors. Tailor each communication to reflect the recipient’s unique profile, including their investment history, industry interests, and investment philosophy.

Show that you’ve done your homework by referencing specific aspects of their portfolio or previous investments that align with your business.

Utilize LinkedIn’s array of tools, such as InMail for direct and professional communication, and profile insights to gain a deeper understanding of your audience.

This level of customization not only demonstrates your dedication but also increases the relevance and impact of your messages, making them more compelling and likely to elicit a positive response.

5. Plan and Execute Follow-Up Strategies

A thoughtful follow-up strategy is essential to maintain engagement while respecting the investor’s space.

After your initial sequence, plan your follow-up messages based on the investor’s responses or lack thereof. If they showed interest, tailor your follow-up to deepen the conversation, perhaps by offering more detailed information or suggesting a meeting.

If there was no response, a gentle reminder highlighting a key aspect of your proposal can be effective. Always keep your follow-ups professional and considerate of the investor’s time.

This balance of persistence and professionalism shows your commitment and respect for the potential relationship, increasing the likelihood of a successful engagement.

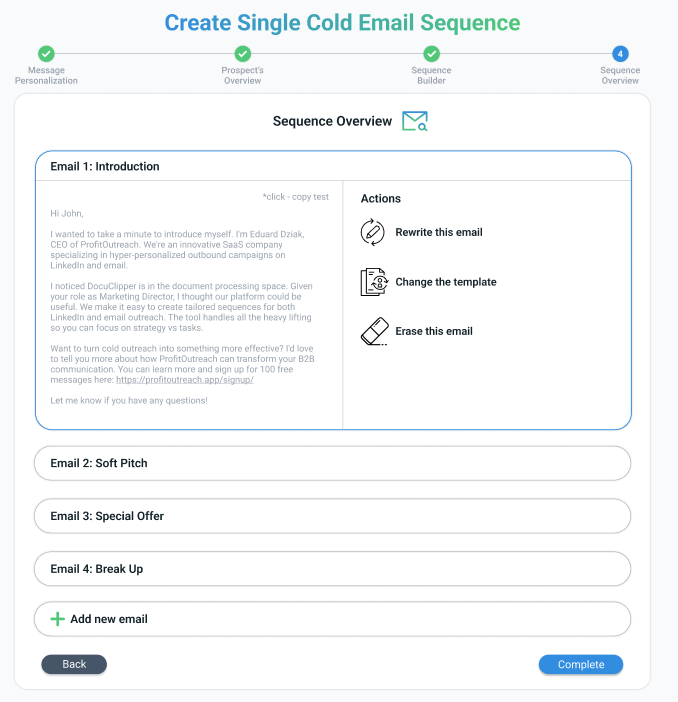

How Does ProfitOutreach Help You Create Investor Pitch LinkedIn Sequence?

ProfitOutreach is a game-changer for businesses looking to create effective Investor Pitch LinkedIn Sequences.

Here’s how it assists:

- Automated Personalization: ProfitOutreach allows you to automate and personalize your LinkedIn outreach campaigns. It crafts messages that resonate with each specific investor by using data from their LinkedIn profiles, ensuring a tailored approach that increases engagement and response rates.

- Customizable Message Sequences: With ProfitOutreach, you can choose between preset and custom sequences. Preset sequences are expertly designed for various objectives like investor outreach, while custom sequences offer flexibility to tailor messages according to your specific needs and goals.

- Incorporation of Real Prospect Data: By leveraging real prospect data, ProfitOutreach ensures your messages are not only personalized but also relevant. This increases the chances of your pitch standing out in a crowded inbox.

- Multiple Template Options: The platform provides a range of email and LinkedIn message templates, from introductions to follow-ups, each with best practices embedded. This makes it easy to create a comprehensive and professional investor pitch sequence.

- Versatility and Ease of Use: Whether you’re a beginner or an experienced marketer, ProfitOutreach is user-friendly. It guides you through creating sequences with options for editing, replacing, or removing messages, allowing for easy customization and optimization.

- Integration with LinkedIn Platforms: After creating your sequence, ProfitOutreach offers guidance on how to use it with various LinkedIn sending platforms, further simplifying the process of executing your campaign.

In summary, ProfitOutreach streamlines the process of creating personalized, data-driven Investor Pitch LinkedIn Sequences.

It offers the tools and flexibility needed to craft messages that capture investors’ attention, making your outreach efforts more effective and efficient.

Conclusion

Raising capital is pivotal yet challenging for any emerging startup. Mastering how to effectively grab busy investors’ attention and convey your long-term vision is key to securing the funds you need to transform ideas into reality.

This is where a strategic Investor Pitch sequence on LinkedIn comes in. By combining personalization with persistence, you can showcase traction, competitive advantages, and growth opportunities in a way that gets investors excited.

If you’re looking to scale your startup, implementing a multi-channel effort with LinkedIn outreach at the core will help open doors to new funding sources.

So, start crafting your data-backed story today – and let potential backers directly experience why your business is set to disrupt a multi-billion dollar industry.

Frequently Asked Questions (FAQs) about Investor Pitch LinkedIn Sequence

Here are some common FAQs about Investor Pitch LinkedIn Sequences:

What is an Investor Pitch LinkedIn Sequence?

It’s a series of structured, personalized LinkedIn messages designed to engage potential investors. The sequence typically starts with an introduction, builds up with detailed information about your business, and concludes with a strong call to action for investment.

What types of investors should I target?

Focus on venture capital firms, angel investor groups, high net-worth individuals, and family offices that actively invest in startups in your industry, stage, location, etc. Leverage LinkedIn Sales Navigator to identify specific targets.

How does it differ from other LinkedIn outreach strategies?

Unlike general LinkedIn outreach, the Investor Pitch Sequence is specifically tailored for fundraising purposes. It focuses on engaging a targeted group of potential investors with personalized messages that align with their interests and investment profiles.

How can I stand out among other startup pitches?

Share unique accomplishments like promising partnerships, clinical trial results or intellectual property. Use visual assets like video demos. Quantify the progress you’ve made and hurdles overcome.

How long should my LinkedIn Sequence be?

A typical sequence consists of 4-5 messages. Start with a brief introduction, followed by messages that gradually provide more depth about your venture, and culminate in a direct investment pitch or call to action.

What are the key components of a successful Investor Pitch LinkedIn Sequence?

Key components include a clear value proposition, personalization, a structured message flow, professional and engaging content, and a strong call to action. It’s also important to maintain a balance between being persuasive and respectful of the recipient’s time.

Can I automate my Investor Pitch LinkedIn Sequence?

Yes, tools like ProfitOutreach allow for automation while maintaining personalization. They help in creating, scheduling, and sending sequenced messages, making the process more efficient.

How do I measure the success of my LinkedIn Sequence?

Success can be measured by engagement rates (e.g., response, click-through rates), progression to meetings or calls, and ultimately, securing investment. LinkedIn analytics and feedback from your outreach tool can provide insights into the effectiveness of your sequence.

What should I do if I don’t receive a response to my sequence?

If there’s no response, a polite follow-up message after some time is advisable. However, it’s important to know when to move on and focus on other potential investors.

Is the Investor Pitch LinkedIn Sequence suitable for all types of businesses?

While most beneficial for startups and companies seeking investment, any business looking to engage with investors can adapt this strategy. The key is tailoring the content to your specific industry and investment requirements.

How often should I update my Investor Pitch LinkedIn Sequence?

Regular updates are important to ensure your sequence reflects current market trends, recent achievements of your company, and evolving investment landscapes. Revising your messages every few months or after major company milestones is a good practice.

Can I use the same sequence for all investors?

While the structure of the sequence might remain consistent, personalization is critical. Tailoring each sequence to the specific investor based on their interests, background, and investment history is recommended for better engagement and results.