Raising funds is a critical, yet challenging part of launching or growing a business. Securing investment is key to fuel innovation and enabling scale.

For startups seeking funding in today’s dynamic landscape, a well-crafted investor pitch cold email sequence can make all the difference.

This unique outreach method effectively piques investor interest and kickstarts fundraising discussions.

In this post, we’ll explore what makes investor pitch emails impactful, strategies to deploy them, and how tools like ProfitOutreach can optimize the process.

What is an Investor Pitch Cold Email Sequence?

An investor pitch cold email sequence is a targeted outreach campaign focused on obtaining financing from angel investors, venture capital firms, or other funding sources.

The goal is to spark interest and secure meetings to pitch a business opportunity.

These customized sequences differentiate themselves from other marketing tactics in a few key ways:

- Specific targeting – Sequences are sent to individual investors or firms likely to fund specific industries, business models, locations, stage of growth, etc. General cold email blasts lack this nuance.

- Multi-touch, personalized messaging – Pitch sequences feature multiple emails sent over weeks or months to build familiarity and convey details on the investment opportunity. Each message is tailored to the recipient.

- Value focus – Well-crafted sequences aim at communicating return potential rather than making direct sales pitches. The goal is to show how the startup and product are worthwhile investments.

Keeping the specifics of the investor in mind allows this approach to stand out from broader promotional initiatives.

When done effectively, pitch email sequences get the critical fundraising conversation started.

Why is the Investor Pitch Cold Email Sequence Useful?

Investor pitch sequences provide startups seeking to fund a way to efficiently reach and engage qualified leads – filling the funnel for one of the most critical business growth objectives.

This targeted approach to securing financing offers several unique benefits:

- Gain direct access to decision-makers able to fund at scale.

- Cost-effective compared to other lead gen strategies.

- Allows personalized communication to showcase the investment opportunity.

- Drives higher response and conversion rates through persistent, value-focused messaging.

- Surmounts challenges connecting with investors inundated with proposals.

The multi-channel, metrics-driven nature of sequences also enables testing and optimization. Startups can refine messages and build relationships in a scalable way.

Software automation lends speed while preserving customization based on investor priorities and parameters.

In the competitive quest for fundraising, investor-tailored email sequencing is an adaptable, measurable channel able to deliver results.

The approach aligns outreach with the methodical, data-driven mindset of venture capitalists and angel investors alike.

Overall, pitch sequences drive financing conversations central to startup success.

What Businesses Should Use Investor Pitch Cold Email Sequence?

Implementing an Investor Pitch Cold Email Sequence can be particularly beneficial for certain types of businesses and industries. These include:

- Startups and Early-Stage Companies: Businesses in their infancy, especially those needing seed or Series A funding, can greatly benefit from this approach. They often lack the visibility and network to attract investors, and a well-crafted cold email sequence can bridge this gap.

- Tech and Innovation-Driven Sectors: Companies in technology, biotech, AI, and other innovation-driven fields often require significant investment to develop and commercialize their products. The investor pitch sequence allows them to connect with investors who have specific interests in these cutting-edge sectors.

- Green and Sustainable Businesses: With the growing focus on environmental sustainability, businesses in green technology, renewable energy, and sustainable practices can leverage cold email sequences to reach eco-conscious investors.

- Scale-Up Companies Seeking Expansion: Businesses looking to scale or expand into new markets can use this strategy to connect with investors interested in growth-stage funding.

- Specialized Niche Markets: Companies operating in specialized niches might find it challenging to attract mainstream investors. A targeted cold email sequence can help them reach niche investors who have a keen interest or experience in specific market segments.

- Real Estate and Property Development: This sector often requires substantial capital. A targeted approach can help these businesses connect with real estate investors and investment groups.

- Creative and Entertainment Industries: For projects like film production, gaming, and other creative ventures, which might not fit traditional investment models, a tailored email pitch can be effective.

- Healthcare and Pharmaceutical Companies: These businesses, particularly those involved in new drug development or medical technologies, require substantial investments. They can benefit from reaching out to investors who are specifically interested in healthcare advancements.

The key reason these industries benefit from an Investor Pitch Cold Email Sequence is their need for substantial capital, combined with the fact that their value propositions are often highly specific and best understood by a niche group of investors.

This approach allows them to directly reach and communicate effectively with potential investors who are most likely to be interested in their specific business model or industry.

Best Practices for Investor Pitch Cold Email Sequence

Here are some best practices and common pitfalls when creating and executing Investor Pitch Cold Email Sequences:

Best Practices:

- Research investors thoroughly to segment based on industry, stage, location, and funding models. Targeting the sequence is key.

- Highlight traction and metrics showing market validation and future potential. Investors need to see growth.

- Focus early emails on piquing interest before making an explicit fundraising ask. Build intrigue first.

- Keep emails concise yet compelling. Quickly communicate your value proposition.

- Personalize each message while scaling outreach. Use merge tags, customized messaging per recipient.

- Follow up persistently over months if needed. Investors are busy, so sustained visibility helps.

- Track open and click rates to optimize and improve sequence performance. Continually refine based on data.

Common Pitfalls:

- Casting too wide of an investor net without custom targeting and relevant messaging.

- Making fundraising asks too early without demonstrating value. Overeager pitches backfire.

- Using boring, generic messaging that fails to stand out. Personalization is a must.

- Giving up too fast if initial emails receive no reply. Persistence pays off.

- Failing to track and iterate messaging. Data insights should inform improvements.

Overall, the keys are crafting compelling, customized narratives; persisting politely through follow-ups; and optimizing based on investor behavior over time.

Avoid blanket blasting and rapid asks to start. Patience and sequencing are allies.

Examples of Investor Pitch Cold Email Sequence

Creating detailed examples for three different Investor Pitch Cold Email Sequences, each with five emails, can provide a comprehensive understanding of how these sequences can be adapted to various contexts or objectives.

Here’s a breakdown of each sequence:

Sequence 1: Tech Startup Seeking Seed Investment

Email 1: Introduction and Vision

- Subject Line: “Revolutionizing [Industry] with Cutting-edge Tech”

- Content: Introduction of the startup, the vision, and the gap it intends to fill in the market.

- CTA: Invitation for an introductory call to discuss the vision further.

Learn how to create this template:

Email 2: The Product and Its Unique Value

- Subject Line: “A Closer Look at Our Game-Changing Product”

- Content: Detailed information about the product, its uniqueness, and potential market impact.

- CTA: Request for feedback on the product concept.

Learn how to create this template:

Email 3: Traction and Market Potential

- Subject Line: “Proven Traction and Expanding Market Opportunities”

- Content: Data on current traction, user feedback, and market analysis showcasing growth potential.

- CTA: Suggest a meeting to discuss market opportunities.

Email 4: Investment Details and Use of Funds

- Subject Line: “Join Our Journey: Investment Opportunities Ahead”

- Content: Specifics about the investment sought, including funding goals and how the funds will be used.

- CTA: Invite to review a detailed investment proposal.

Email 5: Final Pitch and Urgency

- Subject Line: “Final Call: Be a Part of Our Tech Revolution”

- Content: A recap of the opportunity, highlighting any recent successes or endorsements, and a note on the closing window for investment.

- CTA: Direct request for a final decision meeting.

Learn how to create this template:

Sequence 2: Sustainable Energy Company Expansion

Email 1: Introduction to Company and Mission

- Subject Line: “Leading the Charge in Sustainable Energy Solutions”

- Content: Overview of the company, its mission in sustainable energy, and its impact so far.

- CTA: Invitation to learn more about the company’s mission in a brief call.

Learn how to create this template:

Email 2: Success Stories and Impact

- Subject Line: “Real Impact: Our Sustainable Solutions in Action”

- Content: Case studies or examples of successful projects, showcasing real-world impact.

- CTA: Offer to provide detailed case study documents.

Learn how to create this template:

- Social proof cold email template

- Customer story cold email template

- Testimonial cold email template

- Case study cold email template

Email 3: Expansion Plans and Market Analysis

- Subject Line: “Green Horizons: Our Plan for Sustainable Expansion”

- Content: Details on expansion plans, market analysis, and potential for growth.

- CTA: Suggest a meeting to discuss expansion strategy.

Email 4: Investment Opportunities and Benefits

- Subject Line: “Invest in a Greener Future: Sustainable Growth Awaits”

- Content: Information on investment opportunities, potential returns, and the benefits of investing in sustainable technology.

- CTA: Request to review an investment prospectus.

Learn how to create this template:

Email 5: Urgency and Final Offer

- Subject Line: “Last Chance to Join Our Sustainable Vision”

- Content: Emphasize the urgency and limited availability of the investment opportunity, highlighting recent achievements.

- CTA: Direct call for a decision or final meeting.

Learn how to create this template:

Sequence 3: Biotech Firm Seeking Series A Funding

Email 1: Company Introduction and Vision

- Subject Line: “At the Forefront of Biotech Innovation”

- Content: Introduction to the company, its groundbreaking work in biotechnology, and vision for the future.

- CTA: Invitation to discuss the company’s vision in a personal call.

Learn how to create this template:

Email 2: Research Breakthroughs and Potential

- Subject Line: “Groundbreaking Research with Global Impact”

- Content: Details of recent research breakthroughs, potential applications, and impact on the biotech industry.

- CTA: Offer to send detailed research reports.

Email 3: Market Opportunity and Growth

- Subject Line: “Biotech Growth: A Market Ripe for Innovation”

- Content: Analysis of the biotech market, growth trends, and potential for new innovations.

- CTA: Propose a meeting to explore market opportunities.

Learn how to create this template:

Email 4: Funding Goals and Utilization

- Subject Line: “Your Opportunity in Biotech Innovation”

- Content: Specific investment request, including funding goals, planned utilization of funds, and projected outcomes.

- CTA: Invite to review a detailed funding proposal.

Email 5: Closing the Deal and Building the Future

- Subject Line: “Join Us in Shaping the Future of Biotech”

- Content: Final appeal, emphasizing the potential of the investment and the closing window of opportunity.

- CTA: Request for a final decision meeting or call.

Learn how to create this template:

How to Create Your Own Investor Pitch Cold Email Sequence

For startups, crafting and executing targeted investor pitch sequences is a data-driven strategic endeavor.

Amidst fierce fundraising competition, sequencing can drive interest and action while scaling – differentiating the outreach process.

By identifying precise targets, conveying compelling value, optimizing based on investor parameters, and leveraging tools for impact at scale, entrepreneurs can elevate their visibility at the right time to close rounds faster.

1. Identify your fundraising goal

The starting point is defining your specific capital needs – both the amount sought and planned usage.

Outline the funding stage (seed, Series A, etc), the total raise amount, and timeframe or milestones.

Clearly detail how incoming funds will fuel metrics and traction over 12-24 months. For example, highlight if targeting $750K seed round for scaling dev team and advanced prototype testing.

Or perhaps raising a $3 million Series A to expand sales and marketing pipelines in new regions.

When paired with traction, projections, and startup stage, the fundraising goal and allocated usage directly inform the sequencing message and right investors to target.

The more precise the plan for investment dollars, the better. Identify growth levers to pull through strategic financing so messaging inspires action.

2. Research your target investors

With your fundraising goals framed, thoroughly research and compile relevant investors. Search databases like Crunchbase to identify angels, micro VCs, and firms specializing in your industry vertical and business model.

For example, a machine learning startup would identify AI-focused funders. Segment by geographic regions as well, like targeting West Coast investors.

You can use tools like Pitchbook to gather intel on investment history, portfolio preference patterns and sizing, and contact data.

Compile investor emails and any preference or past funding data to inform messaging personalization for each recipient later.

The investor targeting process lays the foundation for sequence relevancy, while enabling you to highlight domain experience to those who value it – driving interest through ideal positioning.

3. Craft your sequence messaging

With ideal investors identified, craft targeted messaging conveying your value and vision. Highlight current traction and metrics that showcase market validation and potential.

Emphasize factors core to your competitive differentiation now and in future. Efficiently communicate how you excel where others fall short.

Also explain your market landscape, viability of your business model, and the exponential growth trajectory ahead.

Importantly, detail how incoming investor funds would fuel these opportunity areas – whether expanding capabilities, accelerating user adoption, or boosting revenue channels.

Outline the measurable impact potential. Personalize messaging per recipient by showcasing relatable upside based on their focus areas and past investments.

Blend facts, metrics, and vision with concise writing to compel action amidst overloaded inboxes.

4. Develop compelling sequence content

With messaging defined, craft content that sustains engagement across sequence emails.

Cold email subject lines should create intrigue and urgency to open while directly relating to the funding goals and investor preferences based on research.

Within the emails, ensure copy is clear, concise and scannable – communicate value quickly then link to documents and collateral expanding on relevant KPIs, financials, projections, and other key details.

These documents, hosted securely on platforms like DocSend, allow custom reporting so you can see who viewed what collateral pieces. This drives relevance.

Within emails, include varied calls-to-action that deliver value for investors, like scheduling intro meetings, accessing financial models, holding Q&A sessions, or even soliciting direct feedback that can be addressed in later sequence messages when appropriate.

5. Execute and optimize outreach

With targets defined, messaging crafted, and content created – efficiently execute at scale.

Email sequence software automates deploying hundreds of initial cold emails while scaling personalized follow-ups based on links clicked, meetings booked, and replies.

Observation and adaptation is key; monitor metrics like open and click-through rates to continuously optimize elements that work.

If certain investors highly engage with projections, send updated versions. Tools enable A/B testing subject lines and content as well.

Persist politely with 2-3 follow-ups over months to overcome inbox noise, complementing sequences with other outreach like LinkedIn connection requests and ads.

Meeting critical fundraising goals requires visibility, so leverage email analytics to break through while delivering relevance through customization.

Data plus sequencing drives fundraising success.

How ProfitOutreach Helps You Create Investor Pitch Cold Email Sequence?

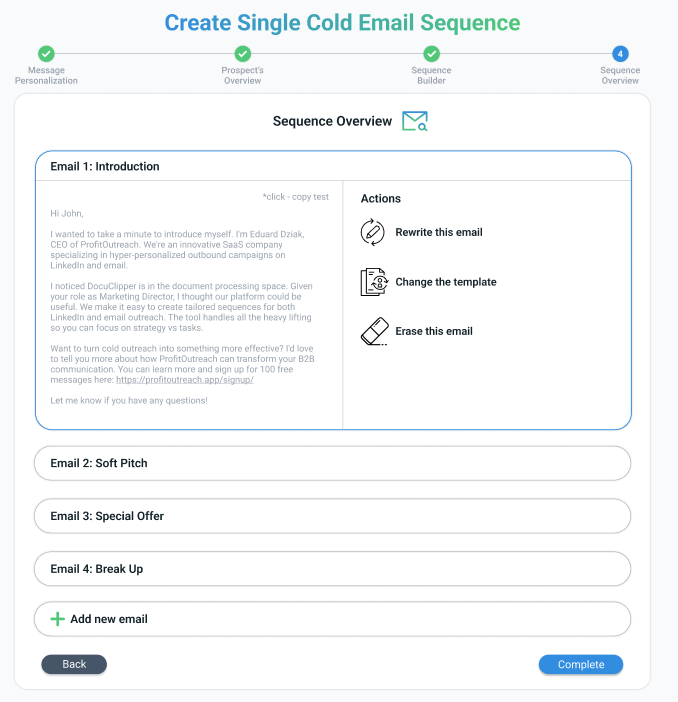

ProfitOutreach is a versatile tool that can significantly enhance the creation of an effective Investor Pitch Cold Email Sequence.

Here’s how it assists users in this process:

- Personalization at Scale: ProfitOutreach specializes in crafting personalized cold email sequences. Utilizing data from LinkedIn profiles, company pages, and websites, it ensures each message resonates with the individual investor, increasing the likelihood of engagement.

- Versatile Template Options: Users can choose between preset sequences for beginners or custom sequences for more control. This flexibility allows for tailoring the sequence according to the specific context of the investor pitch, whether it’s for a startup seeking seed funding or a scale-up in expansion mode.

- Adjustable Tone and Content: The tool allows users to select the tone of the emails (formal, casual, friendly, etc.), aligning the communication style with the target investor’s preferences. Furthermore, it offers a range of email templates like introductions, follow-ups, case studies, and more, each accompanied by best practices to guide content creation.

- Seamless Integration with Email Platforms: Once the sequence is generated, ProfitOutreach provides guidance on using the sequence with various email sending platforms. This feature ensures a smooth transition from sequence creation to execution.

- Customization and Optimization: Users have the option to edit emails, replace templates, or remove emails from the sequence, allowing for ongoing optimization. This adaptability is crucial for refining the pitch based on investor feedback or changing circumstances.

- Comprehensive Support Material: Alongside the sequence generation, ProfitOutreach provides articles and guides to help users maximize the impact of their email sequences. This educational component is invaluable for users new to investor outreach.

In summary, ProfitOutreach streamlines the process of creating a tailored Investor Pitch Cold Email Sequence.

Its capabilities in personalization, flexibility in sequence creation, and integrative features make it an essential tool for businesses looking to effectively engage with potential investors.

Conclusion

Securing startup funding is essential yet highly competitive. Cutting through the noise to engage qualified investors requires a strategic, targeted approach.

As outlined, investor-focused email sequencing enables entrepreneurs to drive relevant conversations with personalized narratives at scale.

By leveraging automation and optimization, these sequences capture attention, demonstrate potential, and ultimately motivate investment.

For any startup, taking the time to craft quality sequences targeting ideal leads can become a fundraising force multiplier.

The path to securing rounds faster starts here. Begin building your investor pipeline through impactful sequencing today.

Frequently Asked Questions (FAQs) about Investor Pitch Cold Email Sequence

Here are some common FAQs about Investor Pitch Cold Email Sequences, along with informative answers to each:

How long should each email in the sequence be?

Each email should be concise yet informative, typically between 100-200 words. The key is to communicate your message effectively without overwhelming the reader. Focus on one main point per email.

How many emails should be in an Investor Pitch Cold Email Sequence?

A typical sequence includes 4-6 emails. This allows enough touchpoints to build interest and credibility without being too intrusive. The sequence should start with an introduction and gradually build up to the investment ask.

How frequently should I send emails in the sequence?

The frequency can vary, but a common approach is to send the first follow-up a few days after the initial email, and then space out subsequent emails by a week or two. It’s important to be persistent but not overly aggressive.

What should the first email of the sequence include?

The first email should introduce yourself and your company, briefly describe your value proposition, and state why you’re reaching out to this particular investor. It should pique interest without going into too much detail.

If I don’t get replies, should I keep emailing investors?

Persistence pays off more often than not. Continue nurturing investor leads with valuable content until you get a firm “no.” Moving on too quickly leaves opportunities on the table.

What metrics indicate my sequences are working effectively?

Open and click-through rates demonstrate engagement over time. Most importantly, meetings booked and capital raised show true sequence success. Continually optimize based on these metrics.

Should I include attachments in my emails?

It’s generally better to avoid attachments in initial emails to prevent them from being marked as spam. Instead, offer to send more detailed information, such as a pitch deck or business plan, in subsequent communications once interest is established. (Learn more about cold email vs spam email)

How do I ensure my email doesn’t get marked as spam?

To avoid the spam folder, personalize your emails, use a clear and professional subject line, avoid overly promotional language, and ensure compliance with email regulations like CAN-SPAM.

Is it okay to follow up if I don’t receive a response?

Yes, follow-ups are crucial. If you don’t receive a response, it’s acceptable to send 2-3 follow-up emails, spaced appropriately. These emails should add value or offer new insights, not just repeat the initial message.

How can I track the effectiveness of my cold email sequence?

Use email tracking tools to monitor open rates, click rates, and response rates. This data will help you gauge the effectiveness of your sequence and make necessary adjustments.

Can I use a template for my Investor Pitch Cold Email Sequence?

Templates can be a good starting point, but it’s vital to personalize each email to reflect the unique aspects of your business and the specific interests of the investor.

What’s the best way to end an Investor Pitch Cold Email?

Conclude with a clear call-to-action that suggests a next step, such as scheduling a call or meeting, or asking for feedback on your proposal. Make it easy for the investor to take action.